Basic Concept

For S&B Foods to become a company that can develop in perpetuity toward the achievement of our corporate philosophy in any type of business environment, we are always searching for the most effective business management framework for adapting to changing business environments.

We strive to maintain a corporate governance framework that streamlines business, contributes to corporate compliance, and creates trust among all stakeholders involved in S&B Foods’ business activities.

Governance Overview

| Organizational design | Company with an audit and supervisory committee |

|---|---|

| Chairman of the Board of Directors | President |

| Number of directors (excluding directors who are members of the Audit & Supervisory Committee) / Of which, number of outside directors | 8 / 2 |

| Number of directors who are members of the Audit & Supervisory Committee / Of which, number of outside directors | 4 / 3 |

| Board of Directors meetings held per year | On or prior to June 26, 2024 4 meetings Attendance rate: 100% for directors; 100% for auditors On or after June 27, 2024 8 meetings Attendance rate: 100% for directors excluding Audit and Supervisory Committee members; 100% for directors who are Audit and Supervisory Committee members |

| Audit and Supervisory Committee meetings held per year | 5 meetings Attendance rate: 100% for directors who are Audit and Supervisory Committee members *Figures for the period on or prior to June 26, 2024, omitted |

| Nomination Advisory Committee | The Nomination Advisory Committee, chaired by an independent outside director and composed of five directors appointed by resolution of the Board of Directors, drafts the original motion for the appointment and dismissal of directors and executive officers, as well as deliberates on the standards and process of appointment and dismissal, and reports to the Board of Directors. Number of meetings held per year: 4 Attendance rate: 100% |

| Remuneration Advisory Committee | The Remuneration Advisory Committee, chaired by an independent outside director and composed of five directors appointed by resolution of the Board of Directors, deliberates on the policy and decision process of individual director and executive officer remuneration, as well as the specific amount of remuneration for individuals, and reports to the Board of Directors. Number of meetings held per year: 3 Attendance rate: 100% |

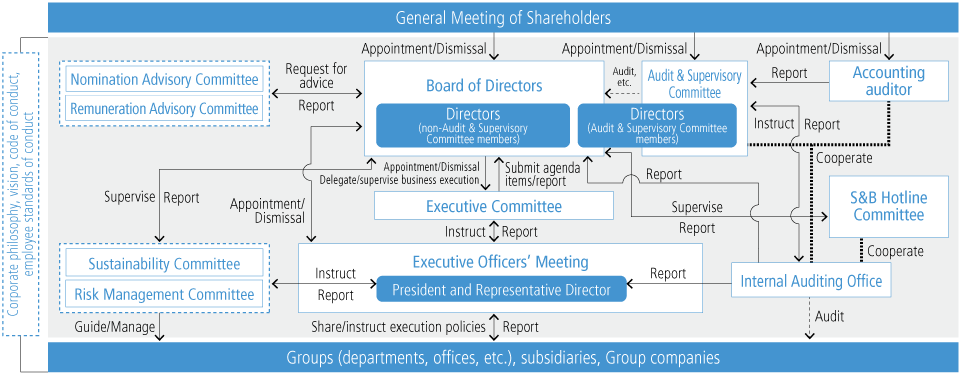

Corporate Governance Framework

The executive officer system has been introduced in order to separate management decision and auditing functions from business execution functions, with the Board of Directors in charge of the former and the executive officers in charge of the latter.

This framework not only speeds up management and business execution-related decision-making and execution of duties, but also enhances the supervisory function and clarifies the authority and responsibilities of the Board of Directors and executive officers.

Corporate Governance Framework Diagram (as of June 27, 2025)

|

Our Approach to Diversity in the Board of Directors

In consideration of the scale of business and business domains, our Board of Directors, including outside directors, is balanced in terms of individual experience and capabilities without bias toward specific fields of expertise, and without favoring certain nationalities or genders.

Board of Directors Training Policy

We provide sufficient training opportunities so that directors’ functions of supervising management and directors who are Audit & Supervisory Committee members’ functions of management monitoring are sufficiently demonstrated, and we actively provide support by bearing seminar costs.

Board of Directors Effectiveness Evaluation

We hold regular and, as necessary, ad-hoc meetings of the Board of Directors to make prompt decisions on important business execution and to supervise the execution of duties by directors.

In addition, each director (excluding outside directors and directors who are Audit and Supervisory Committee members) conducts a self-evaluation and multifaceted evaluation within the individual performance evaluation system.

The following is a summary of the methodology and results of the evaluation of the overall effectiveness of the Board of Directors.

| 1. Evaluation Method | |

|---|---|

| Period | April to May 2025 *To be deliberated at the Board of Directors meeting in June 2025 |

| Format | Questionnaire |

| Eligible respondents | All directors |

| Questionnaire items |

|

| 2. Summary of Results | |

|---|---|

| Our Board of Directors, in discussions given the above, has assessed that the effectiveness of the Board of Directors is reasonably assured. We will continue to strengthen corporate governance and work to improve its effectiveness by invigorating discussions to resolve management issues from a medium- to long-term perspective. |

Policies and Procedures for Election of Directors

Under the executive officer system, the Company clearly identifies authority and responsibility for management decisions and auditing and business execution, respectively, and makes it a policy to appoint senior management and nominate director candidates who have the requisite qualifications for fulfilling these roles. Based on this policy, the Board of Directors makes decisions on the appointment and dismissal of directors and executive officers based on findings of the Nomination Advisory Committee, an advisory body to the board, after deliberations to ensure objectivity and transparency.

The policy for nominating candidates for directors who are members of the Audit & Supervisory Committee is that they have the qualifications necessary for auditing duties, with the final decision made with the approval of the Board of Directors after obtaining the consent of the Audit & Supervisory Committee.

Outside directors are also required to meet the Company’s independence criteria.

Independence Criteria for Outside Officers

The criteria for determining the independence of the Company’s outside directors are based on the judgment that the Company can ensure substantial independence by applying the requirements for independent directors stipulated by financial instruments exchanges.

Remuneration Determination Policies and Calculations

The total amount of remuneration for the directors (excluding directors who are members of the Audit & Supervisory Committee) of S&B Foods is within 30 million yen per month, by resolution of the General Meeting of Shareholders.

The amount of remuneration, etc., for each individual director (excluding outside directors), within the scope of the total amount of remuneration, consists of fixed remuneration and performance-based remuneration, which are determined taking into account the roles, responsibilities, and performance (adjusting for corporate performance factors), as well as share-based remuneration outside the above-mentioned remuneration limit, which is determined based on roles and responsibilities, in accordance with the regulations established by the Board of Directors.

The amount of remuneration, etc., for each of the Company’s outside directors (excluding directors who are members of the Audit & Supervisory Committee) consists of fixed remuneration only, within the scope of the above-mentioned remuneration limit and in consideration of their respective roles, and is stipulated in regulations.

For the remuneration, etc., of individual directors of the Company (excluding directors who are members of the Audit & Supervisory Committee), the indicators for performance-based remuneration include not only quantitative measures in the financial statements linked to the Medium-Term Business Plan, such as sales and operating income, but also the degree of achievement of targets by each director and their respective divisions.

The policies for determining the amount and calculation method of performance-based remuneration take into account the roles, responsibilities, and performance (adjusting for corporate performance factors) of individual directors (excluding directors who are members of the Audit & Supervisory Committee), and the Board of Directors has the authority to determine the amount and calculation method.

For the remuneration, etc., of individual directors of the Company (excluding directors who are members of the Audit & Supervisory Committee), share-based remuneration is provided as consideration for the performance of directors’ duties. They may receive the gratis issuance or disposition of the Company’s common shares (with transfer restrictions), without the need for any monetary payment or other consideration in exchange for the subscription of shares.

The transfer restriction period is set from the date the restricted shares are granted until the day when each of the relevant directors (excluding directors who are members of the Audit & Supervisory Committee) ceases to serve as either a director of the Company or any other position determined by the Company’s Board of Directors. The policy for determining the amount of share-based remuneration and the calculation method is based on the roles and responsibilities of each director (excluding directors who are members of the Audit & Supervisory Committee). The Board of Directors has the authority to determine the amount and calculation method.

The Board of Directors makes a decision on the remuneration, etc., of individual directors of the Company (excluding directors who are members of the Audit & Supervisory Committee) based on the findings of the Remuneration Advisory Committee, an advisory body to the board, after deliberations to ensure objectivity and transparency.

The total remuneration for directors who are members of the Audit & Supervisory Committee is within the monthly limit of 10 million yen approved by resolution of the General Meeting of Shareholders, and the specific amount, timing of payment, and other details are determined through discussions among the Audit & Supervisory Committee member.

Internal Control System

S&B Foods regards its “Corporate Philosophy,” “Vision,” and “Code of Conduct” as its spiritual pillars and believes that thoroughly disseminating these principles to all officers and employees of the S&B Foods Group is essential from the perspectives of corporate ethics, legal compliance, and corporate social responsibility.

The internal control system of the S&B Foods Group has been established to:

- Enhance the effectiveness and efficiency of business management;

- Ensure the reliability of financial reporting;

- Ensure compliance with laws, the Articles of Incorporation, and corporate ethics related to business management; and

- Establish a corporate structure that safeguards corporate assets.

Regardless of the business environment, S&B Foods will continue to engage in the ongoing review and revision of the internal control system to remain a sustainable company.